The Leading AI Debt Collection Software

Debt Manager’s advanced AI-native technology redefines credit risk management.

Debt Manager’s advanced AI-native technology redefines credit risk management.

Take advantage of world-class AI debt collection software. Our solutions harness the power of AI, machine learning, smart workflows, data-driven insights, and powerful rules engines for maximum effect. Humanize every journey to resolve more debt.

Used by 7 of the top 8 UK banks

Used by 6 of the top 7 US banks

Over $8 trillion managed on Debt Manager

Government

Government

Credit Unions

Credit Unions

Telecommunications

Telecommunications

Banking

Banking

Auto Finance

Auto Finance

Collection Agencies

Collection Agencies

Retailers

Retailers

Government

Government

Credit Unions

Credit Unions

Telecommunications

Telecommunications

Banking

Banking

Auto Finance

Auto Finance

Collection Agencies

Collection Agencies

Retailers

Retailers

Government

Government

Credit Unions

Credit Unions

Telecommunications

Telecommunications

Banking

Banking

Auto Finance

Auto Finance

Collection Agencies

Collection Agencies

Retailers

Retailers

Government

Government

Credit Unions

Credit Unions

Telecommunications

Telecommunications

Banking

Banking

Auto Finance

Auto Finance

Collection Agencies

Collection Agencies

Retailers

Retailers

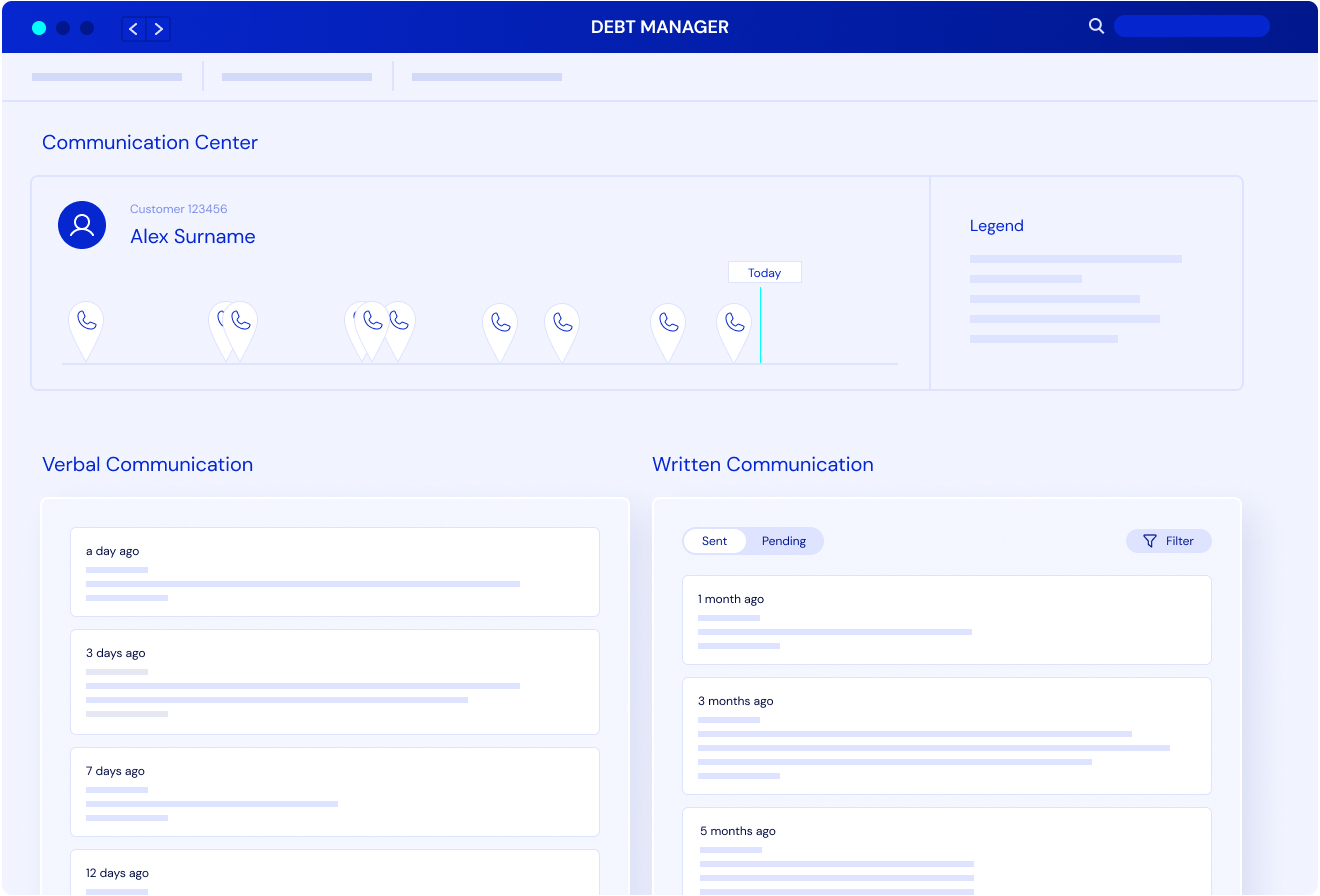

Operationalize AI-backed insights with ease. Advanced rules engines and workflows empower non-technical team members to adapt and respond to the latest developments at speed. Deliver maximum results with minimal effort through C&R Software’s AI debt collection software.

AI-native analytic tools take the guesswork out of team management. From tracking performance to identifying trends in customer behavior, you get a clear, data-driven view of what’s working and what’s not. Use smarter insights to make smarter decisions for your team.

Leverage AI-powered debt collection tools to anticipate call volumes, predict customer behavior, and segment outreach strategies based on risk and potential recovery value. Make a bigger impact by sending critical resources to the places they’re needed most.

Collect more, make better offers, and deliver exceptional service to your customers through the industry’s leading AI debt collection software. Our AI automated debt collection solutions leverage the latest data and insights to deepen your understanding of your customers. Make smarter decisions about when, where, and how to engage with them for maximum results.

Configurable workflows cover all your collections needs. That’s true for all products, for all customers, for the entirety of the credit risk lifecycle. Adjust to changes in customer behavior, react to the latest market developments, and meet new regulatory compliance needs in no time.

Implement C&R Software quickly with our expert support. Our low-code/no code approach brings together data from isolated systems to create a single source of truth. Keep team members, leaders, and third-party agencies on the same page to deliver a high-quality experience for each and every one of your customers.

Reduce the stress and strain on internal teams. AI automated debt collection tools reduce manual processes and maintenance downtime. Free your team members to focus on what really matters to your customers–offering a human touch where it’s most needed.

AI deepens customer relationships. The latest tech anticipates payment behaviors, segments accounts, and matches the right treatment path to every customer. Operationalize advanced insights to optimize customer care with a humanized approach.

AI automated debt collection software maximizes efficiency throughout your organization. Make fast, powerful changes to your strategy and leverage automated tools to make your team more agile and adaptable. Accelerate payment rates and increase customer satisfaction all at once.

For over 40 years, C&R Software has stood out as the industry’s leading provider of credit risk management solutions. Our AI-native debt collection software combines cutting-edge AI and analytics with years of industry experience. Simplify the complex through streamlined workflows and automated rules engines alike.

With a legacy of innovation and an AI debt collection platform designed for simplicity and scalability, we enable credit issuers to redefine their customer journeys while boosting collections rates. Used by banks, credit unions, telecoms, government agencies, retailers, collection agencies, auto, health care providers, utilities and more, Debt Manager is also highly configurable beyond collection and recovery, so you can support customers throughout the entire credit risk lifecycle.

C&R Software takes AI debt collection software to the next level. Trusted by industry leaders in more than 61 countries, our AI automated debt collection solutions leverage the latest technology to optimize outreach, accelerate payment rates, and improve the customer journey from start to finish.

AI and machine learning tools identify which accounts are likely to self-cure ahead of time. By examining a wide range of variables, these models boost prediction accuracy and empower your team to concentrate on more complex customer cases.

Go beyond basic delinquency metrics to evaluate value at risk. AI-powered algorithms take various factors into account, such as customer behavior and engagement strategies. Forecast conditional probabilities more effectively to optimize outreach strategies

Stay compliant with the latest regulatory requirements. AI debt collection solutions automate compliance checks throughout the collection process, reducing the risk of human error. Adopt real-time monitoring tools to ensure all communication adheres to industry standards like TPDCA, CASL, and GDPR.

AI-native tech helps you improve offer uptake and reduce charge-offs. Leverage machine learning models to determine whether customers are likely to self-cure, or whether it’s best to reach out with an offer. Tailor outreach based on the customer’s ability and willingness to pay.

Advanced AI models forecast the most effective pre-charge-off offers, customized to meet the unique needs of both you and your customers. By leveraging sophisticated analytics, these tools ensure the offers align closely with customer profiles, enhancing acceptance rates and improving overall outcomes.

Post-charge-off decisions are optimized through AI-driven models designed to identify the most suitable third-party agency for each account. These tools analyze various factors to ensure the selection aligns with the specific needs of each unique account for more personalized care.

Advanced AI and analytics help you optimize contact strategies. Pinpoint the best times, channels, and messaging sequences for reaching out to customers. Maximize the right-party contact rate and effectively influence customer behavior to ensure outreach efforts are timely, considerate, and relevant.

Engage more effectively with your customers. AI-driven pairing matches collection teams with customers who share similar profiles, leading to improved outcomes and shorter call times. Ultimately, these AI debt collection tools streamline the collection process while increasing recovery rates. Delivering high-quality care encourages lifelong customer satisfaction and loyalty.

Take the first step to transform your collections for the better. Get in touch with a regional expert today to learn more about the AI-powered future of credit risk management.

AI debt collection software is designed to help teams more effectively and efficiently manage their caseloads. Automate routine processes, streamline workflows, and leverage data-driven insights to optimize customer outreach. This cutting-edge technology supports better customer service as well as increased collections rates.

Outdated legacy software tends to rely on costly, time-consuming, and error-prone manual processing. On the other hand, AI-native solutions automate routine tasks to improve employee morale and reduce the overall workload. Send reminders, process payments, and so much more. The time saved through automation helps teams refocus their efforts on complex cases.

Additionally, modern AI debt collection solutions leverage AI-powered predictive analytics to optimize their decision-making skills. These tools identify high-risk accounts, assess customers’ ability to self-cure, and adjust outreach strategies accordingly for the best results.

Deliver personalized payment plans tailored to each customers’ unique situation. AI supports the humanized care your customers expect. Understand their history and behavior and optimize communication strategies to boost engagement and response rates. Build loyalty through a more customer-centric approach.

C&R Software Debt Manager is an AI-native SaaS solution leveraging the latest analytics and algorithms to enhance collections outcomes. Developed over 40 years of comprehensive industry experience, it’s designed to simplify the complex world of debt collections with intuitive interfaces built for technical and non-technical teams alike. Its key features include:

Taken together, these features improve the collections process for teams and their customers alike. Reduce the workload, ease the stress on team members, and redirect their efforts towards higher-value projects. More empathetic interactions with customers increase loyalty, satisfaction, and collections rates.

AI technology supports a more humanized approach to collections. It can’t replace a collections team—but it can certainly enhance their existing capabilities. These AI debt collection tools act as superpowered assistants to experienced professionals by automating routine processes, boosting efficiencies, and performing real-time regulatory monitoring. They’ll help reduce instances of human error while freeing collections to spend more time delivering the compassionate care their customers deserve.

Leverage AI debt collections software to develop a better understanding of your customers’ unique circumstances. Find out whether they’re able to self-cure or adapt payment plans to meet their individual needs. AI analytics inform your outreach strategies, too, so you deliver the most effective messages through the most effective channels. Personalized communication powered by AI boosts customer engagement and satisfaction.

AI automated debt collection tools also support customers through the difficulties of debt collection. Speaking with a team member can be intimidating or embarrassing, especially when dealing with personal matters, and not everyone has the time to wait on the phone. AI improves the customer experience through empowering self-service platforms and 24/7 chatbots designed to answer their concerns any time of day.

Yes, our AI debt collection solutions are designed with an open architecture, so they seamlessly integrate with existing systems. Our low-code/no code approach means you can easily take advantage of institutional data to deliver a seamless customer experience across systems, teams, departments, and agencies alike. Not only does this reduce the stress on collections teams, but it also delivers a more satisfying customer experience.

Our SaaS AI debt collection solutions are fast to implement, too, offering rapid time to value, ease of integration, and the elasticity needed to scale on-demand while managing peak volumes. Eliminate the time and stress of overhauling existing processes, and reduce the hefty maintenance and operating costs tied to outdated legacy software. Debt Manager brings collections teams into the future of credit risk management.